Now let us see each activity on medical Billing

Insurance Verification

Process started from here and usually front desk people are doing this process. Its a process of verifying the patients insurance details by calling insurance or through on line verification. If this department works well, we could resolve more problem. We have to do this even before patient appointment. Here is the nice flowchart from the ZIMMER site on the insurance verification process.

There are different ways you can verify the patient insurance is active or not as follows

- Using medical Billing Clearing house, you can verify each patient insurance.

- There are some public websites where you can verify each patient insurance.

- Most of the insurance company web site has the option of verifying their patient policy is active or not.

- You can create Electronic file (EDI) for bunch of patients and then you can submit to the clearing house to verify. Clearing house in turn will give the report of each insurance.

- You can call the insurance company customer support and check the status.

- You can integrate any third party to check on line with your software to verify the insurance.

By verifying the patient insurance before the appointment, we can save our time and inform the patient to pay from their pocket before the service is rendered.Non- verification of insurance eligibility would lead to problems such as delayed payments, rework, increased errors and patient dissatisfaction. All this underlines the importance of insurance verification in Medical Billing.

Creating the claim and send to the Insurance Company.

Next step is prepare the claim and send to the insurance company via clearing house or directly to the payer.

Claim Processing by the insurance company.

Rejected Claims

When the insurance company receives the claim from the doctor, first level check or first level edit process will start. Here insurance company will check the accuracy of the date submitted before filing the claim into their computer system. If any data is not valid or missing, then it is treated as rejected claims. A rejected claim is one that has not been processed due to problems detected before health care claim processing. Claims are typically rejected for incorrect patient names, date of birth, insurance ID’s, address, etc. Since rejected claims have not been processed yet, there is no appeal - the claim just has to be corrected and resubmitted.

Most Common Reasons for Rejected Claims

- Errors to patient demographic data - age, date of birth, sex, etc. or address.

- Error in Doctor License No.

- Incorrect Patient Policy No.

- Patient Insurance is inactive.

- Incorrect Treatment code or Disease Code.

- Incorrect Modifiers

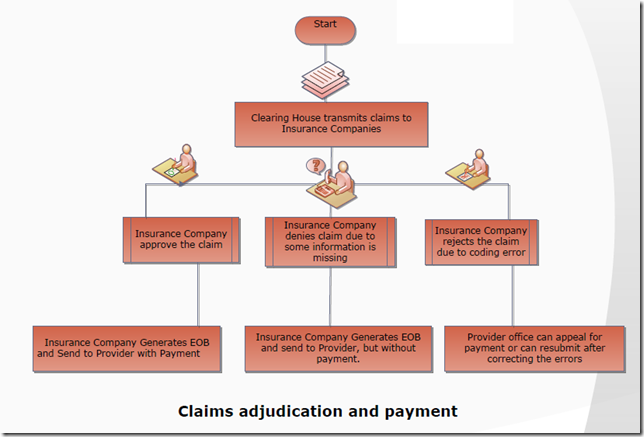

Claims adjudication

After process of first level edit, the information is reviewed to determine whether the patient was covered at the time of service, and whether the treatment is appropriate for the diagnosis submitted. If the procedure or treatment falls within standard and customary treatment for that condition, it is considered medically necessary and the bill is approved for payment. The payment amount will depend on the allowed amount, which varies depending on your particular policy and whether or not your doctor is on a list of network providers. This process is called Claims Adjudication.

There are generally three possible outcomes of adjudication of a claim, whether it is valid and should be paid, it is invalid and should be denied, or more information is need to make a proper determination, in which case it is "pended" for further (usually manual) processing.

Denied Claims

During Claim adjudication, claim may also be denied. Please remember, A denied claim is not the same as a rejected claim, however both terms are frequently used interchangeably. A rejected claim is one that has not been processed due to problems detected before health care claim processing. Claims are typically rejected for incorrect patient names, date of birth, insurance ID’s, address, etc. Since rejected claims have not been processed yet, there is no appeal - the claim just has to be corrected and resubmitted.

A denied claim is one that has been through health care claim processing and determined by the insurance company that it cannot be paid. A denied claim can be appealed by submitting the required information or correcting the claim and resubmitting.

Most Common Reasons for Denied Claims

- Services non-covered. Are the billed services covered under the patient's policy?

- Patient's non-coverage or terminated coverage at the time of service may also be the reason of denial That is why, it is very important that you check on your patient's benefits and eligibility before doctor see the patient.

- Taken long time to submit the claim from the date of the service provided to the patient. Has the claim been sent within the payers time limits for filing claims? The time limit is generally between 90 and 180 days from the date of service.

- Duplicate dates of service.Is the claim billing for a service on the same date that has already been adjudicated?

- Valid code linkages.

- Missing documentation attached to the claim. Payers may require additional documentation, such as the operative note or implant invoice, attached to the claim

The Following picture demonstrates how insurance company processing the claims received from the clearing house.

Payment

Next, the insurance company will either send the appropriate payment electronically to the health care provider, or send a notice of denial if the claim has not met the standards for payment. In either case, the patient will also be notified of the result of the claim. This is usually done via a letter called Explanation of Benefits (EOB) letter, which details the amount that was paid and the portion of the bill that is the patient's responsibility. The EOB letter will also give a reason for denial if payment was not made.

EOB means Explanation of Benefits. Insurance companies send information to both the patient and provider on exactly what they paid and allowed. Allowed amount means the maximum amount the insurance company would consider for payment. Any difference above the allowed amount is written off if the provider participates with the insurance company.

You can see some sample EOB here.

0 comments:

Post a Comment